ev tax credit bill text

The bill extends the tax credit for new qualified plug-in electric drive motor vehicles through 2031. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit.

Wevj Free Full Text Analysing The Cost Effectiveness Of Charging Stations For Electric Vehicles In The U K Rsquo S Rural Areas Html

Beginning on January 1 2021.

. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. Add an additional 4500 for EVs assembled in. Credit for certain new electric bicycles.

The current tax credit has a base of 2500 and is replaced with a new 4000 base credit as long as the EV has a battery of at least 10 kWh and can be plugged in and recharged. Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite objections to. Federal tax credit for EVs jumps from 7500 to 12500 Keep the 7500 incentive for new electric cars for 5 years.

As mentioned below however the 10 kWh battery. The bill also offered record incentives for used electric cars and it would have removed a provision that renders automakers ineligible for existing credits after selling 200000 EVs. When I woke up this morning I found the text of the Senate bill HR1 - Tax Cuts and Jobs Act that was passed last night and skimmed through it looking for anything about the Federal electric.

Bloomberg -- Senate Democrats have scrapped a 4500 bonus tax credit for electric vehicles made with domestic union labor that was opposed by Senator Joe Manchin as they seek to wrap up. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. The Build Back Better legislation passed last year in the House would have increased the 7500 consumer tax credit to as much as 12500 as part of a White House-backed effort to ensure that.

Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite objections to the. Increasing the base credit amount to 4000 from 2500 is fine. 4000 Base Tax Credit.

Meanwhile Republicans on the senate. The proposed EV incentive under Build Back Better includes a current 7500 tax credit to purchase a plug-in electric vehicle as well as 500 if. Last year the US House of Representatives passed the 19 trillion Build Back Better legislation.

Democrats Unveil New EV Tax Credit Proposal. State and municipal tax breaks may also be available. The amount of the credit will vary depending on the capacity of the battery used to power the car.

A Senate version of the EV plan had initially proposed to offer an additional tax credit beyond the base 7500 of 2500 for the buyers of. The federal EV tax credit is calculated based on different factors. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Electric Credit Access Ready at Sale Act of 2021 or the Electric CARS Act of 2021. Depending on your tax circumstances you could be getting up. If you purchased a Nissan Leaf and your tax bill was 5000 that.

Senate Finance Committee Approves 12500 EV Tax Credit Bill. The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers. Under the bill the expanded tax credit is available to taxpayers with an adjusted gross income cap of up to 250000 for individuals and.

The proposed EV incentive under Build Back Better includes a current 7500 tax credit to purchase a plug-in electric vehicle as well as 500 if. The policy written by Stabenow and Democratic Rep. Dan Kildee of Flint Township originally would have raised an existing federal tax credit.

Its good news for General Motors which recently begged the government. On Wednesday the Senate Finance Committee advanced the Clean Energy for America Act making a few tweaks from earlier proposals. The text of the electric vehicle tax credit as it is included in the 175 billion of the budget reconciliation bill can be found here.

A In general Subpart C of part IV of subchapter A of chapter 1 of the Internal Revenue Code of 1986 is amended by adding at the end the following new section. It would limit the EV credit to. For more information about the new Democratic proposal check out these links.

The bill says individual taxpayers must have an adjusted gross income of no more than 400000 to get the new EV tax credit. It is still unclear what reform the EV tax credit will see in the spending bill if any. Updated June 2022.

The credit amount will vary based on the capacity of the battery used to power the vehicle. Changes include raising the federal EV tax rebate ceiling to 12500 and opening the door for automakers who already exhausted. The union provision became one of the major sticking points that helped tank the 17 trillion spending bill last year.

In June the CEOs of GM Ford Stellantis and Toyota jointly urged Congress to lift the cap on the. However most people who file their federal taxes and buy or lease a new EV are eligible for a credit of up to 7500. Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500.

Tax Credit Amount 417 x Total Capacity kWh - 4kWh 2500 For the federal credit a manufacturer will have its credit value halved once 200000 electric vehicles are sold. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned. This bill modifies and extends tax credits for electric cars and alternative motor vehicles.

The bill says individual taxpayers must have an adjusted gross income of no more than 400000 to get the new EV tax credit. By Matt Posky on May 27 2021. A Allowance of credit In the case of an individual there shall be allowed as a credit.

There is no tax credit if you decide to lease a. In addition the bill modifies the credit to. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors.

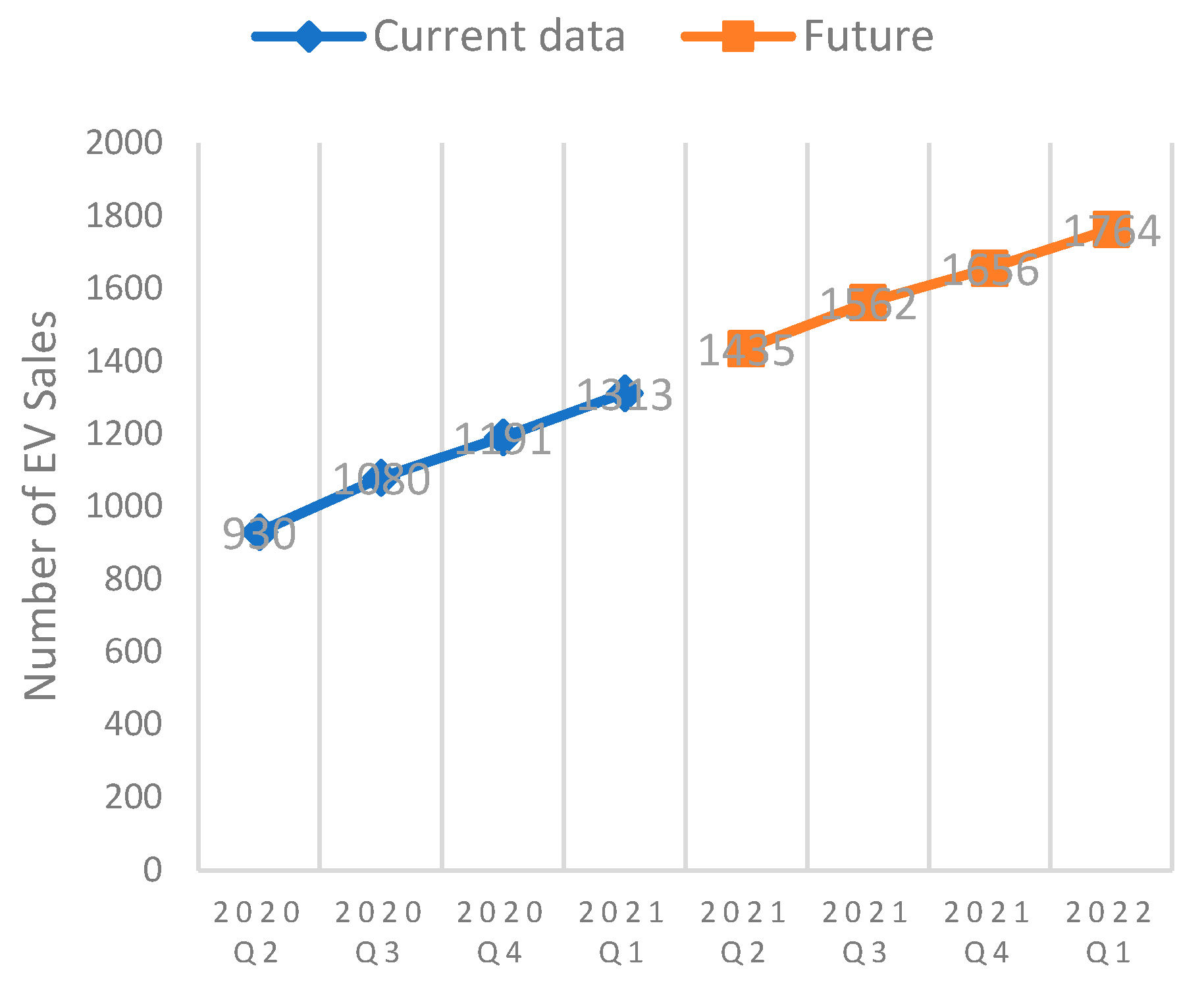

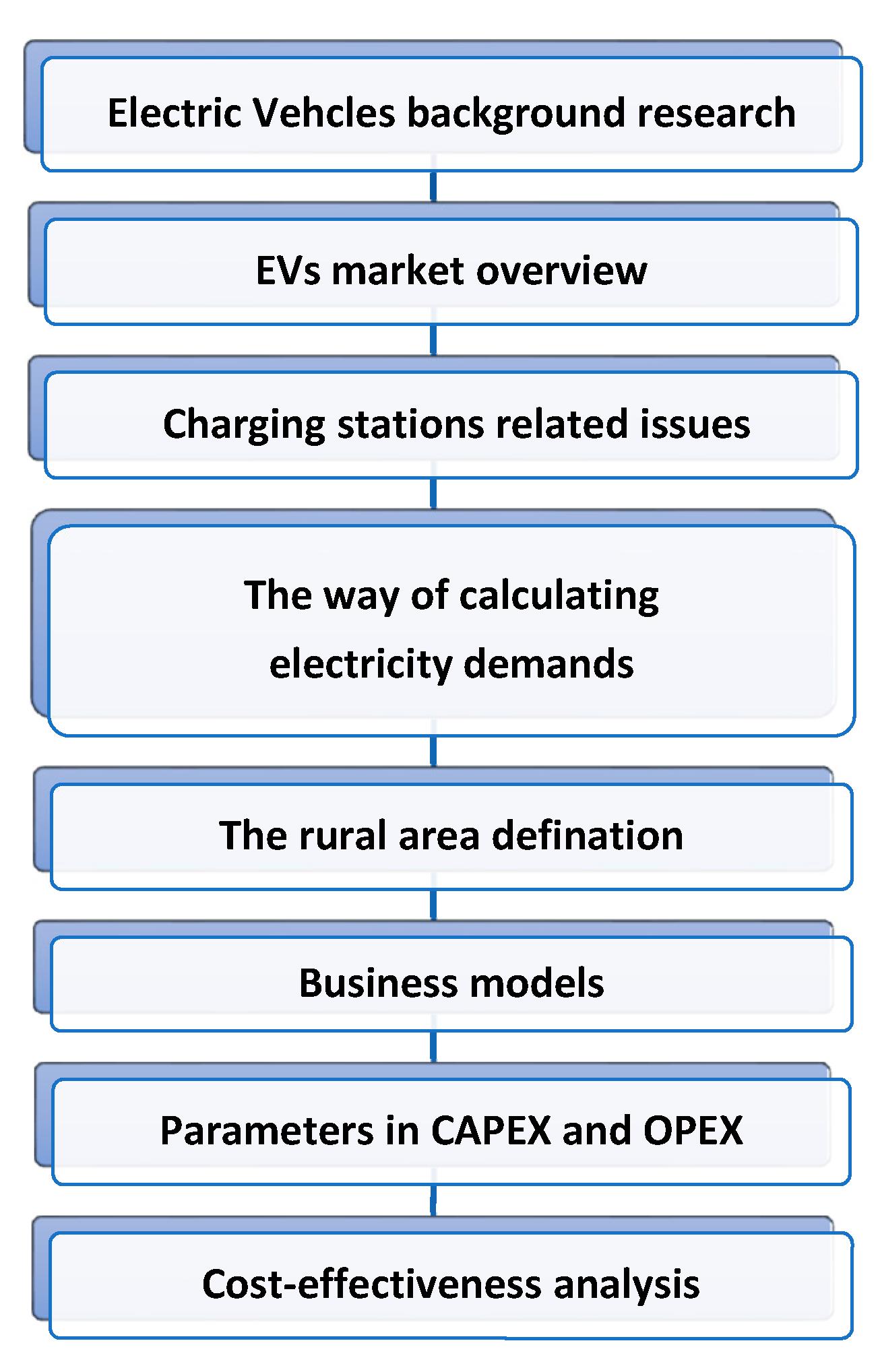

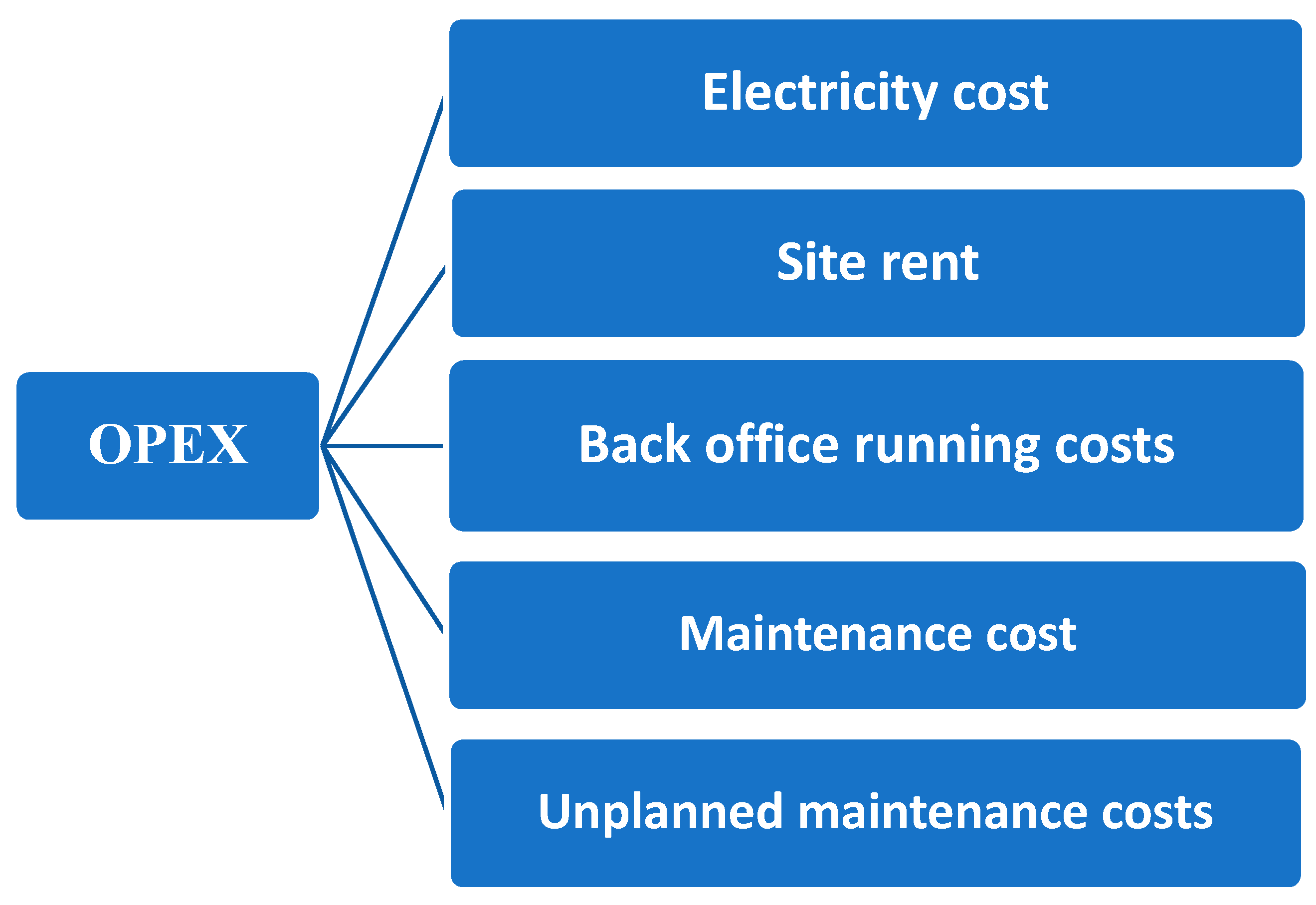

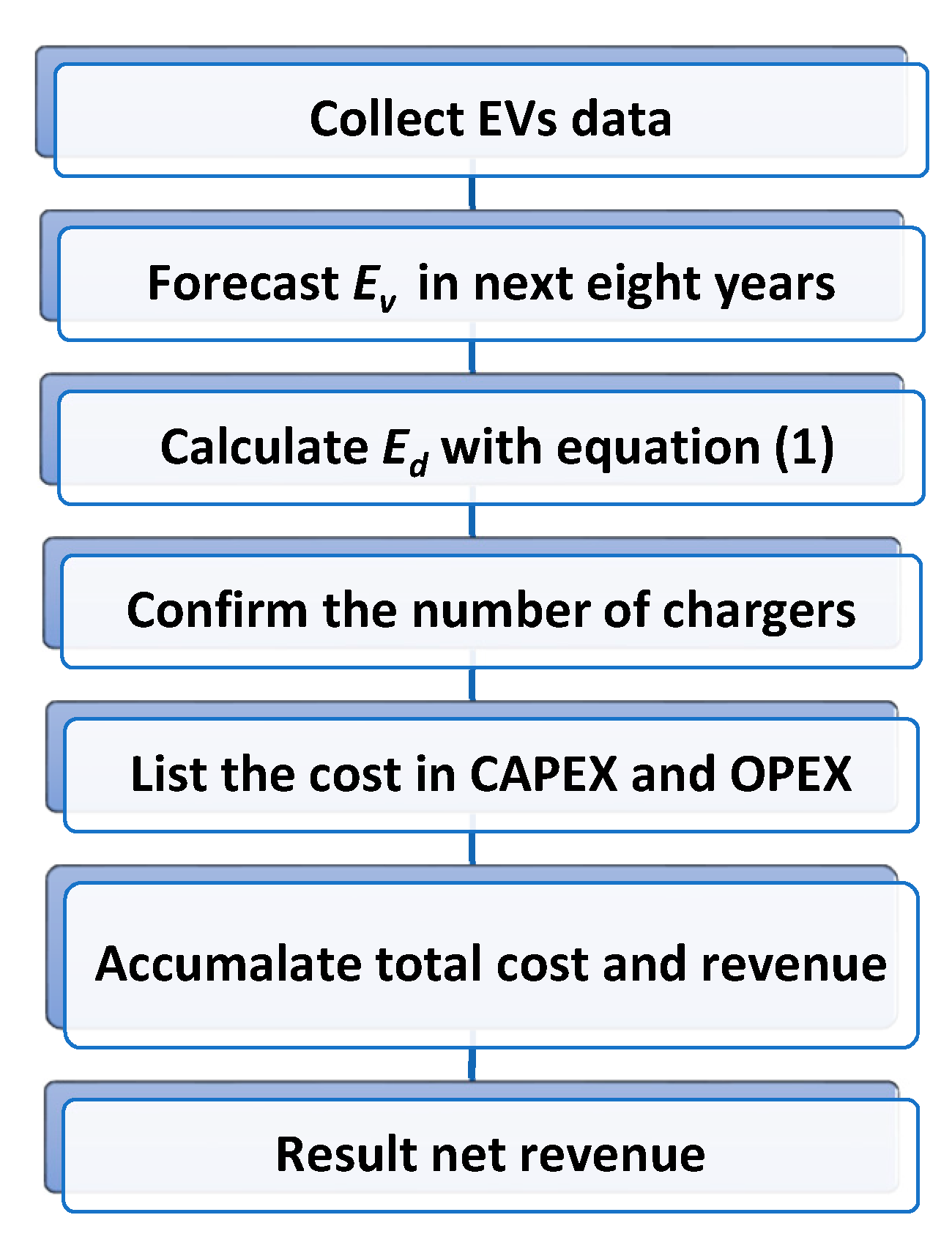

Wevj Free Full Text Analysing The Cost Effectiveness Of Charging Stations For Electric Vehicles In The U K Rsquo S Rural Areas Html

Wevj Free Full Text Analysing The Cost Effectiveness Of Charging Stations For Electric Vehicles In The U K Rsquo S Rural Areas Html

Wevj Free Full Text Analysing The Cost Effectiveness Of Charging Stations For Electric Vehicles In The U K Rsquo S Rural Areas Html

What Are Regulatory Credits And How Tesla Made It A Business Tesla Tesla Shares Automotive Sales

Germany S Greenhouse Gas Emissions And Energy Transition Targets Clean Energy Wire

Solaria Qhi Do It Again Electric Bill S Don T Lie Can You Ask For Better Results Than This I Just Love Understanding Electricity Solar Electric System

Ev Charging Infrastructure Incentives In Europe 2022 Evbox

It May Be Cheaper To Run Maintain And Be Better For The Environment But For Washingtonians Didyouknow Facts Twenty Dollar Bill Gas Tax Personal Finance

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

Wevj Free Full Text Analysing The Cost Effectiveness Of Charging Stations For Electric Vehicles In The U K Rsquo S Rural Areas Html

Everything You Need To Know About Ev Incentives In The Netherlands Evolve