mississippi state income tax brackets

Combined Filers - Filing and Payment Procedures. The graduated income tax rate is.

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

The Mississippi State Tax Tables below are a snapshot of the tax rates and thresholds in Mississippi they are not an exhaustive list of all tax laws rates and legislation for the full list.

. Mississippi also has a 400 to 500 percent corporate income tax rate. Hurricane Katrina Information. Any taxable income exceeding that amount would.

Unlike the Federal Income Tax Mississippis state income tax does not provide. Single tax filers with taxable income up to 27272 double if filing jointly would have been taxed at a rate of 255 percent. For single taxpayers your gross income must be more than 8300 plus 1500 for each dependent.

The plan would immediately eliminate the 4 tax bracket starting in 2023 at a cost of about 185 million to the state budget and then over the next three years step down the. 0 on the first 2000 of taxable income 3. Mississippi based on relative income and earningsMississippi state income taxes are listed below.

As you can see your income in Mississippi is taxed at different rates within the given tax brackets. Single Tax Brackets Married Filing Jointly Tax Brackets For earnings between 100000 and 500000 youll pay. The chart below breaks down the Mississippi tax brackets using this model.

Box 23058 Jackson MS 39225-3058. HOHucator - Tax Tool. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

PENALTYucator - Late Filing Payment Penalties. Detailed Mississippi state income tax rates and brackets are available on. Mississippi Income Taxes.

Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Box 23050 Jackson MS 39225-3050. We can also see the progressive nature of Mississippi state income tax rates from the lowest MS tax rate bracket of 0 to the highest MS tax rate bracket of 5.

In 2028 these rates are scheduled to revert to the pre. Eligible Charitable Organizations Information. The Mississippi Single filing status tax brackets are shown in the table below.

Because the income threshold for the top. If you are receiving a refund PO. In addition check out your federal.

Married taxpayers must make more than 16600 plus 1500 for each. These income tax brackets and rates apply to Mississippi taxable income earned January 1. Income tax brackets are required state taxes in.

Any income over 10000 would be taxes at the highest rate of 5. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Tax Rate Income Range.

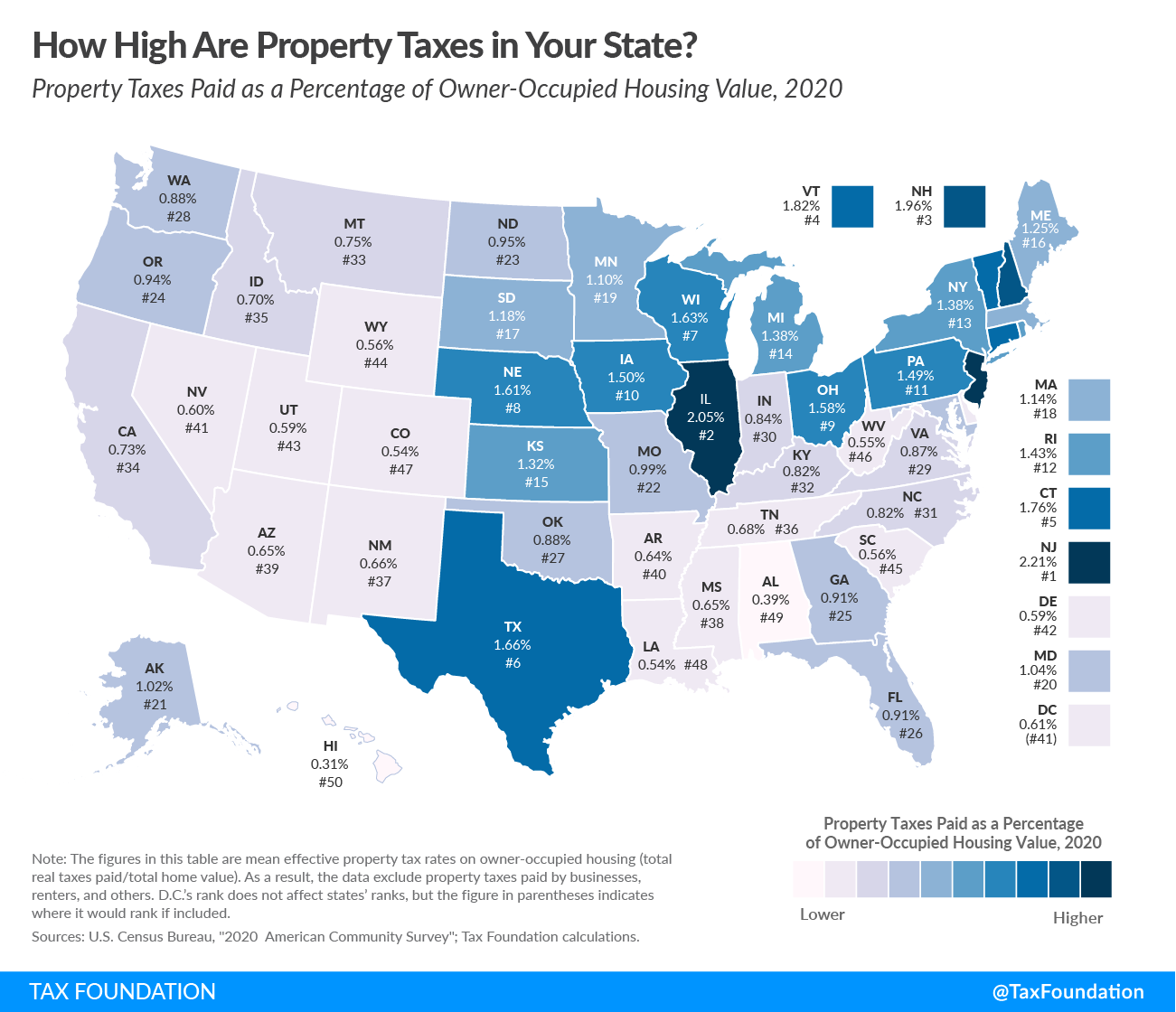

There is no tax schedule for Mississippi income taxes. Mississippi has a 700 percent state sales tax rate a max local sales tax rate of 100 percent and an average. STATucator - Filing Status.

EITCucator - Earned Income Tax Credit. All these rates apply to incomes over 2 million with the highest rate of 1090 applying to incomes over 25 million. These rates are the same for individuals and businesses.

Mailing Address Information. All other income tax returns P.

Mississippi State Income Tax Ms Tax Calculator Community Tax

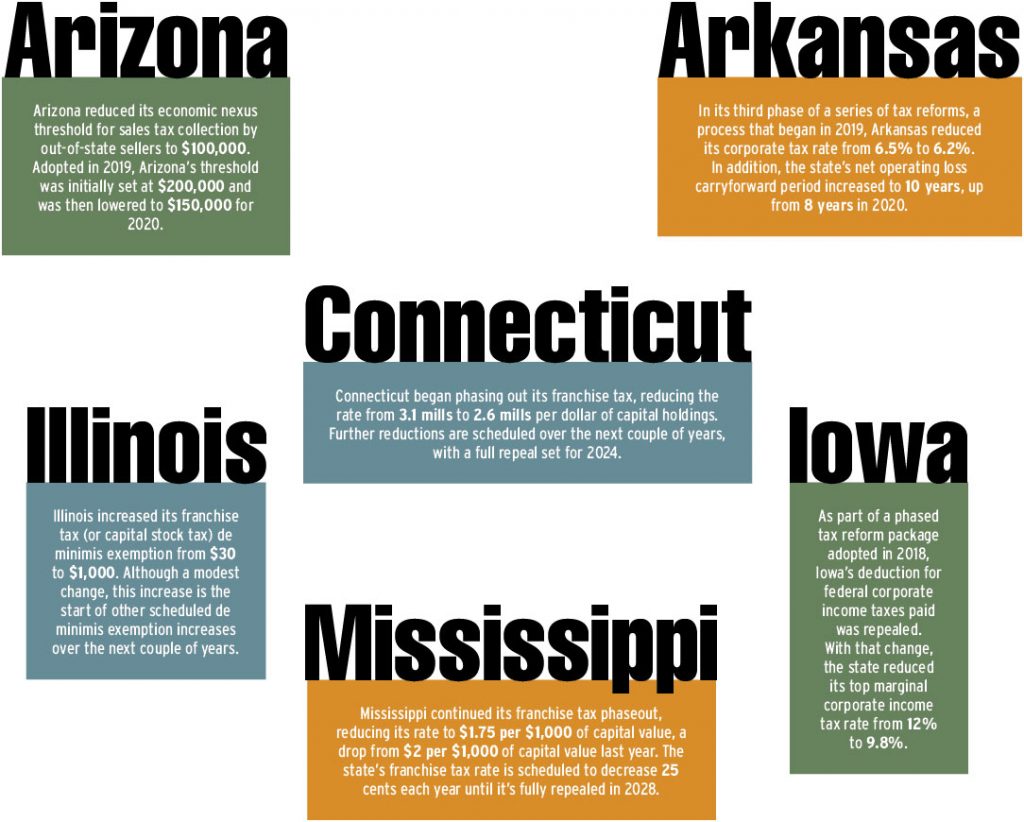

State Tax Updates In 2021 Tax Executive

New Yorkers Paid Less In Federal Taxes In First Year Of New Federal Tax Law Empire Center For Public Policy

Will Mississippi Join The No Income Tax Club International Liberty

Mississippi State Tax Tables 2021 Us Icalculator

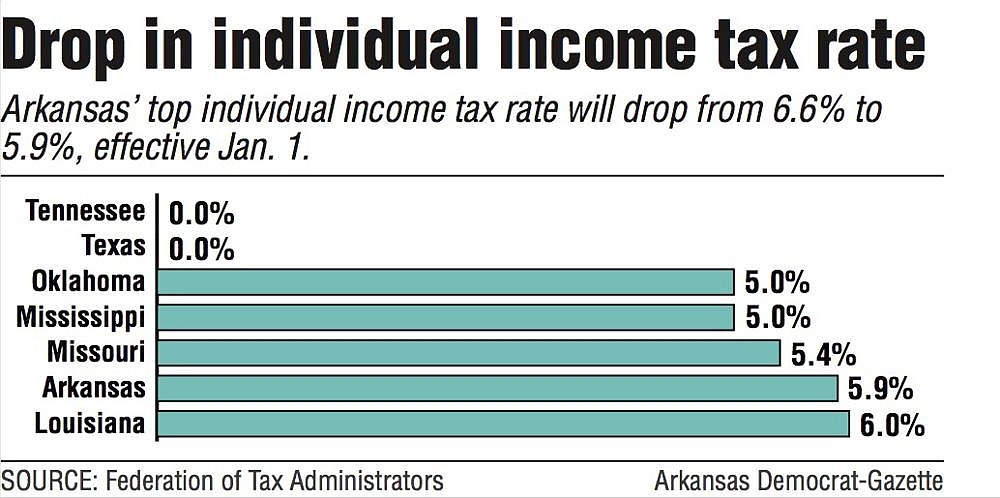

State S Top Income Tax Rate Dips To 5 9 Today

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

Mississippi Income Tax Calculator Smartasset

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

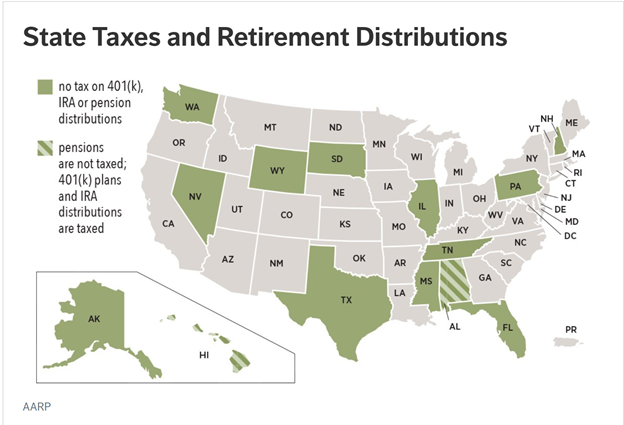

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Mississippi State Income Tax Ms Tax Calculator Community Tax

Policy Basics Marginal And Average Tax Rates Center On Budget And Policy Priorities

Michigan Income Tax Rate And Brackets 2019

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

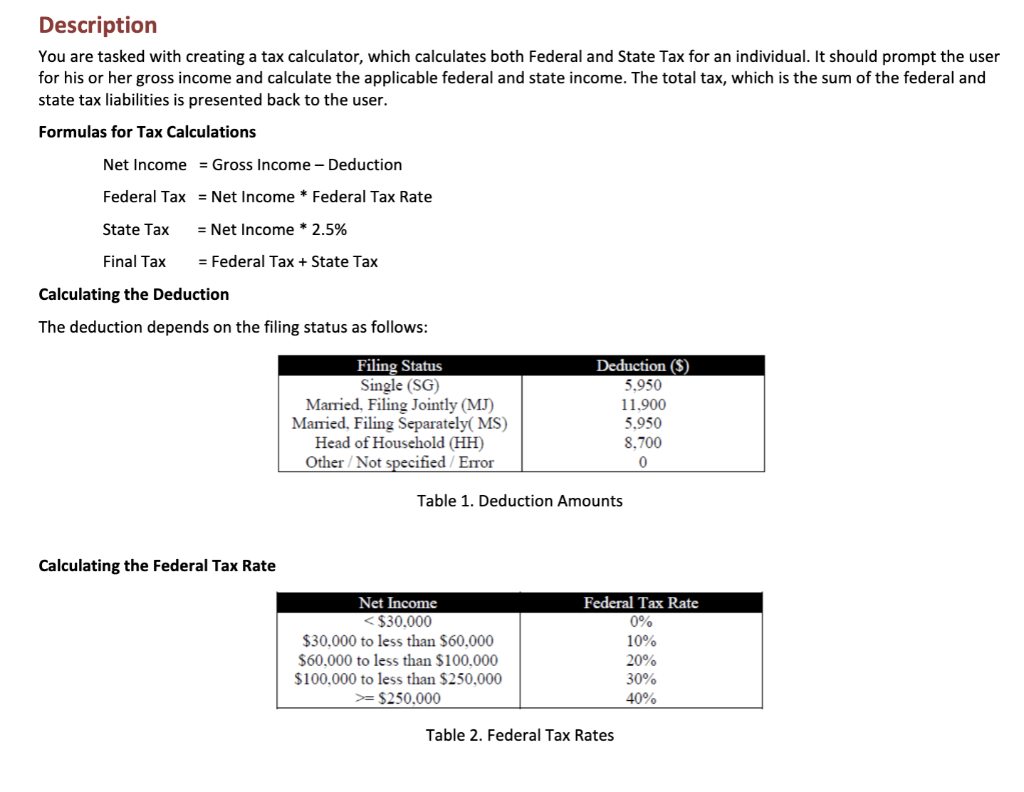

Solved Description You Are Tasked With Creating A Tax Chegg Com

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation